Aka, the DAI of DAI, the native Ethereum stablecoin for fast and cheap P2P transactions, and one of the more hyped projects to come out of the Ethereum developer ecosystem in 2019. By way of xDai recently raising a $500k round led by B-Tech - the investment arm of BitMax.io and Focus Labs - the project came to my attention recently and thought it would make for a good Daily exploration. So without further ado, I'll take some time to present you with the TL;DR on xDai, along with a few quick-fire thoughts on what's good and what's not about the project.

What is xDai?

xDAI is both an Ethereum sidechain, and a token that is pegged to the US Dollar via the DAI, has extremely low transaction fees, and very fast transaction times.

The project was brought to life in a collaboration between POA Network (one of the more active developer teams within Ethereum) and Maker DAO. Users can convert Dai to xDai via POA Network’s TokenBridge, which connects Ethereum and xDai chain.

How does xDai work?

The xDai blockchain is a wholly separate network from the Mainnet that achieves much higher throughput by scaling up the block size and scaling down the block producer (validator) count. The sidechain mechanism is powered by POA's Tokenbridge, and as such requires an own set of validators, separate to those active in Mainnet.

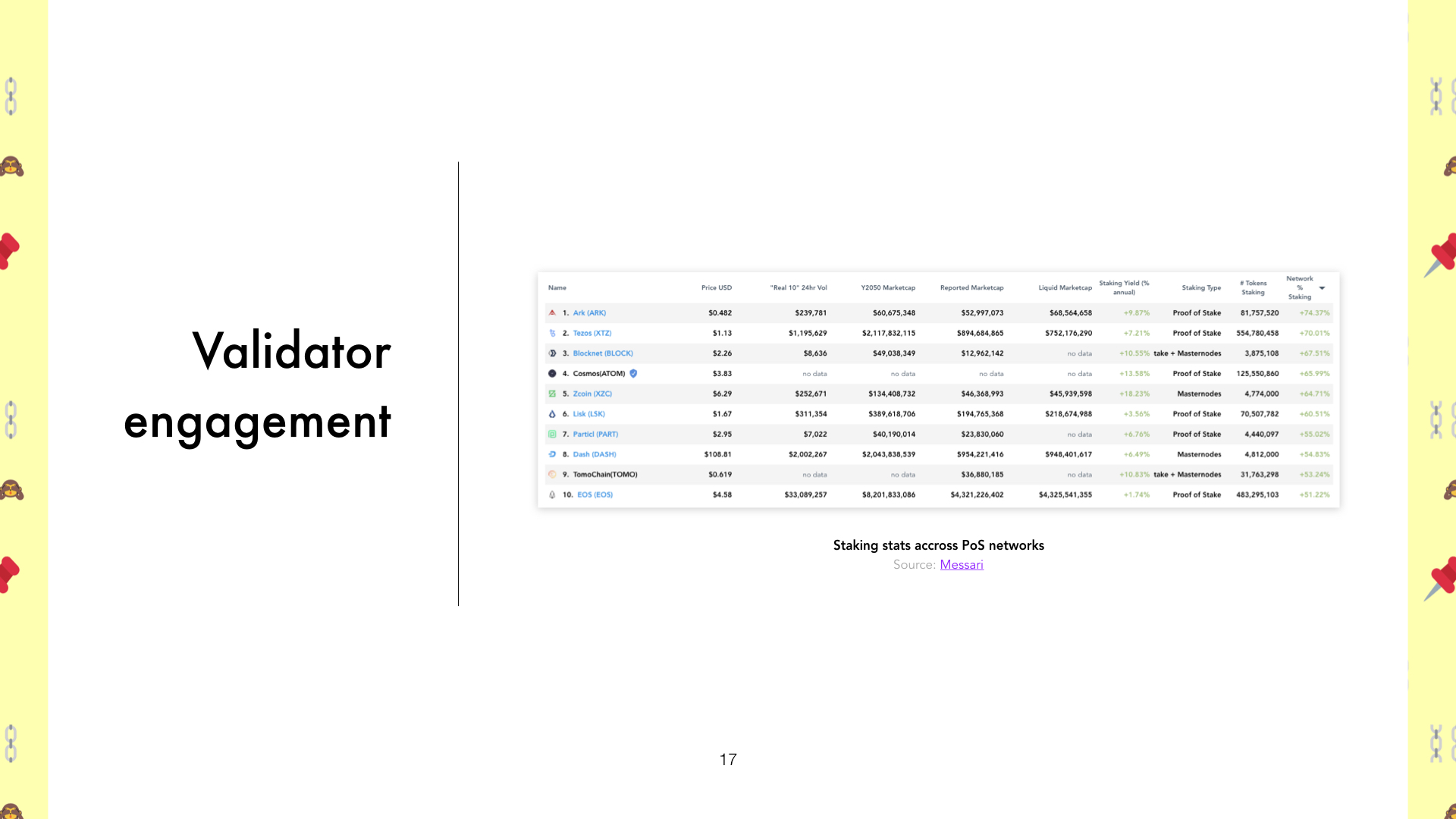

xDai works with 10 validators that are responsible for running nodes and setting the network parameters.

The way xDai is minted works as follows: you lock DAI in a contract on Mainnet, and the validators on the xDai chain mint DAI on the xDai chain to you. Effectively, xDai trades decentralization for performance.

Why xDai and not just DAI?

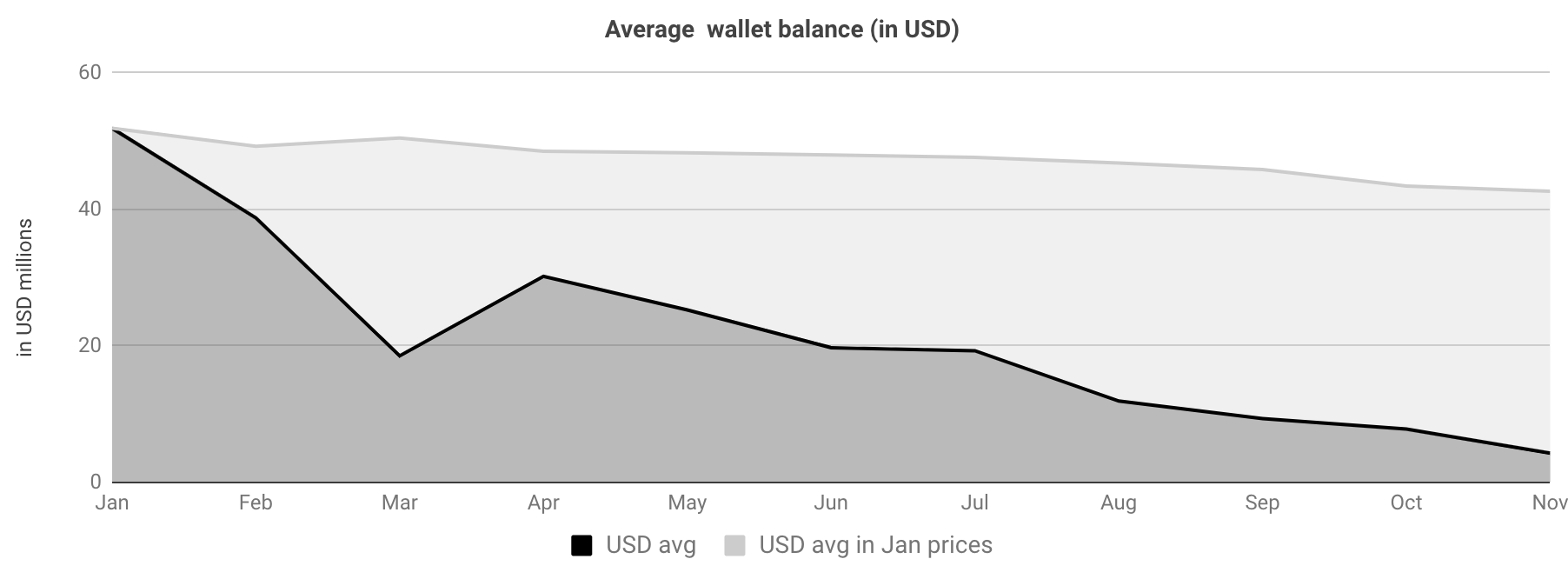

As a Mainnet token, the DAI is subject to the wild fluctuations that transaction costs on the Ethereum network undergo - tied to a large extent to the availability of resources on the network.

The chart below shows how the history of the median transaction fee on Ethereum, since Q3 2017. Indicatively the median tx fee for 2019 is close to $0.1.

Via the sidechain mechanism (and some sort of transaction batching/key-synching bridge with Mainnet) xDai manages to perform transactions at a steep discount to DAI on the Ethereum Mainnet. More specifically, the cost to perform a transaction on xDai, is about $0.000021.

As we explored above, more recently the same function in Ethereum costs 4000x more (or 0.25% of the transaction value on average), while in the normal financial world, with what it costs to send money in the normal the cost of money transfers is upwards 3% (for international transfers).

Similarly xDai records impressive performance in the transaction speed dimension too. Transactions on the xDAI blockchain occur within five (5) seconds, while a typical Ethereum transaction takes about 1–3 minutes and a normal financial world international transfer, way over 24 hours.

And what about early traction?

Established in October 2018, xDai Chain has attracted the attention of the ecosystem, thanks in no small part to Austin Griffith’s Burner Wallet, which provides a quick and easy way to carry and exchange small amounts of spending-crypto using a mobile browser and serves as a low-friction way to onboard new users.

xDai was used at ETHDenver (Feb 2019) as a platform for the Burner wallet, which allowed thousands of attendees to seamlessly buy food and transfer funds. 11 food trucks accepted xDai via Burner Wallets and sold 4,405 meals for a total of $38,432.56. And the total fees were only $0.20.

xDai was also used during ETH New York, though no similar figures have been made public. Beyond that, there is only one Dapp outside the wallet contingent that uses xDai - and that is the somewhat fringe prediction's market Helena.

Having reviewed what xDai is and how it works - brief as it might have been, let's now consider what xDai has going for it and where it falls short.

In favour of xDai...

- Ultra fast and cheap transactions with stable value. Could really be a game changer for Dapp adoption by providing a significant UX improvement.

- Can see it having significant impact in P2P payments (although one can argue that this is not really a problem in the developed world).

- Supported by two of the strongest developer groups in crypto (MakerDAO and POA).

Against xDai...

- Pegged to DAI, therefore pegged to USD, right? Wrong! The DAI is notorious for breaking its peg with the USD.

- If Ethereum eventually scales via Ethereum 2.0, then xDai is obsolete, as the DAI itself will enjoy similar transaction speed and cost.

- Clunky UX; like with many things in crypto, getting xDai as a user, is far from easy. A user journey would look like this: buy ETH on Coinbase (Pro) with USD, exchange ETH for DAI, transfer the DAI to the Dex Wallet mobile app (dl the app), and exchange DAI for xDAI. Far from ideal.

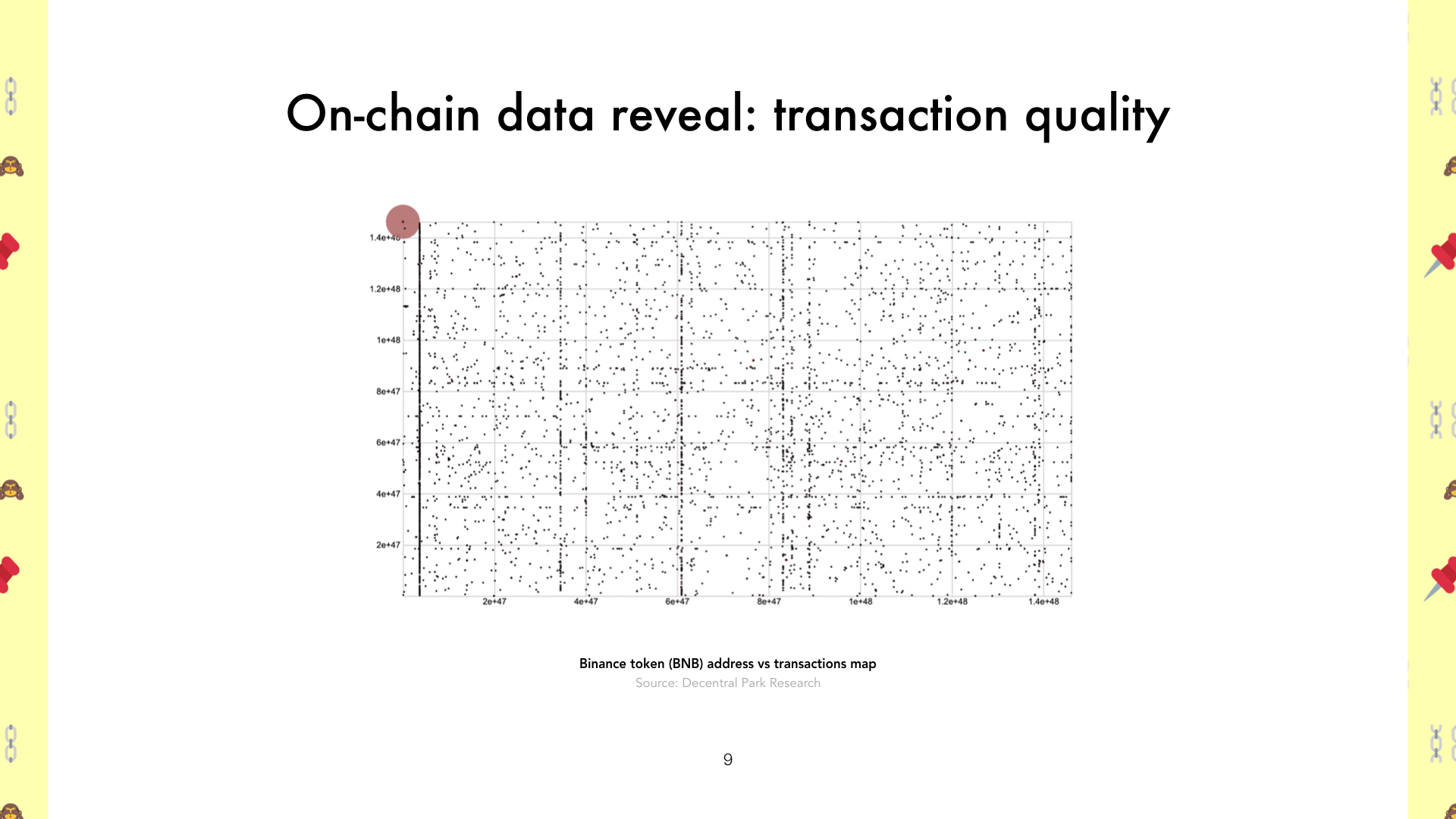

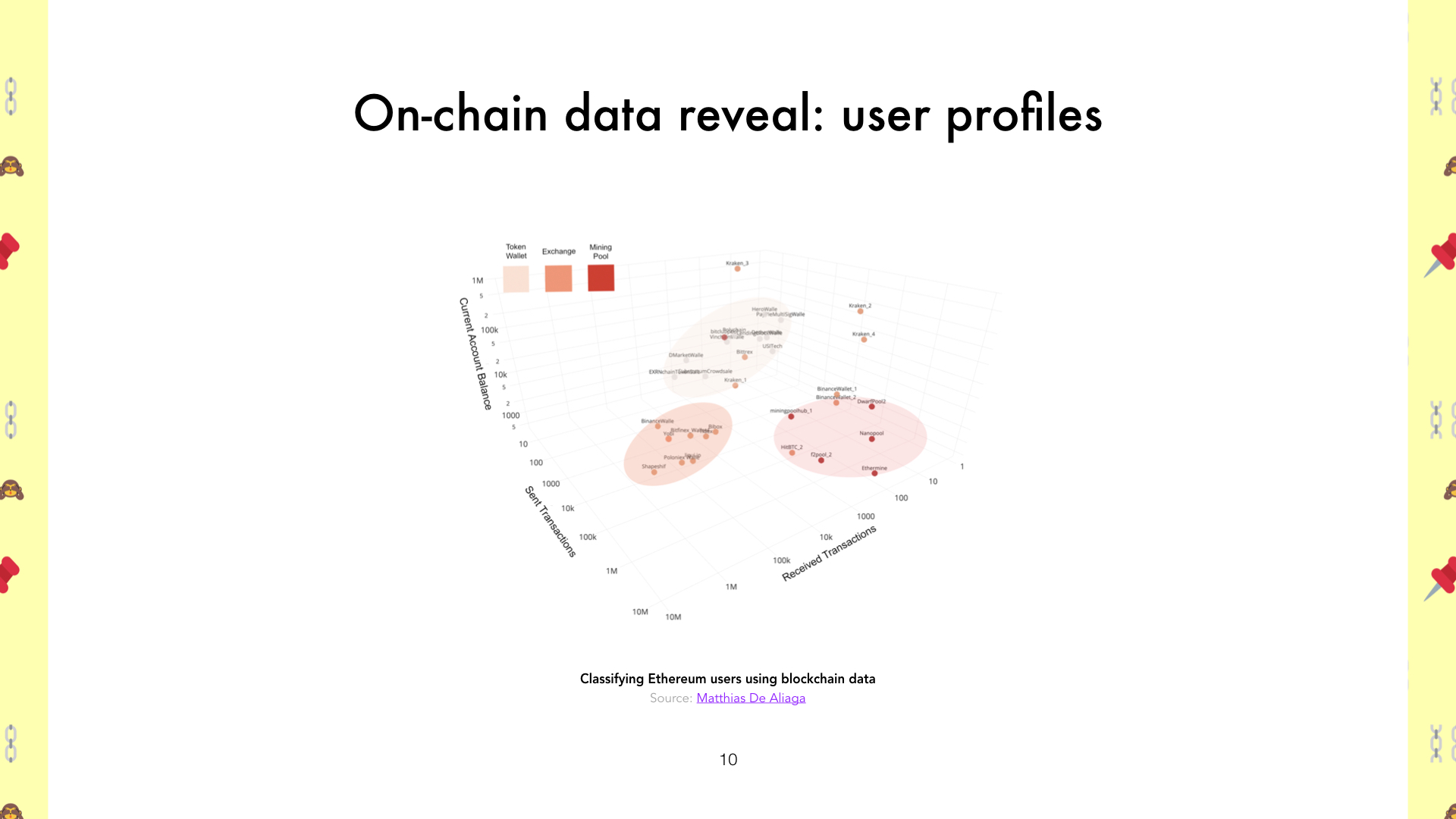

- Adoption story is over-sold; a quick glance at the types of transactions taking place on the xDAI chain, show virtually 0 P2P usage. Contract call type transactions are disproportionately high, while the most common USD amount transacted comes with 4 to 5 decimals.

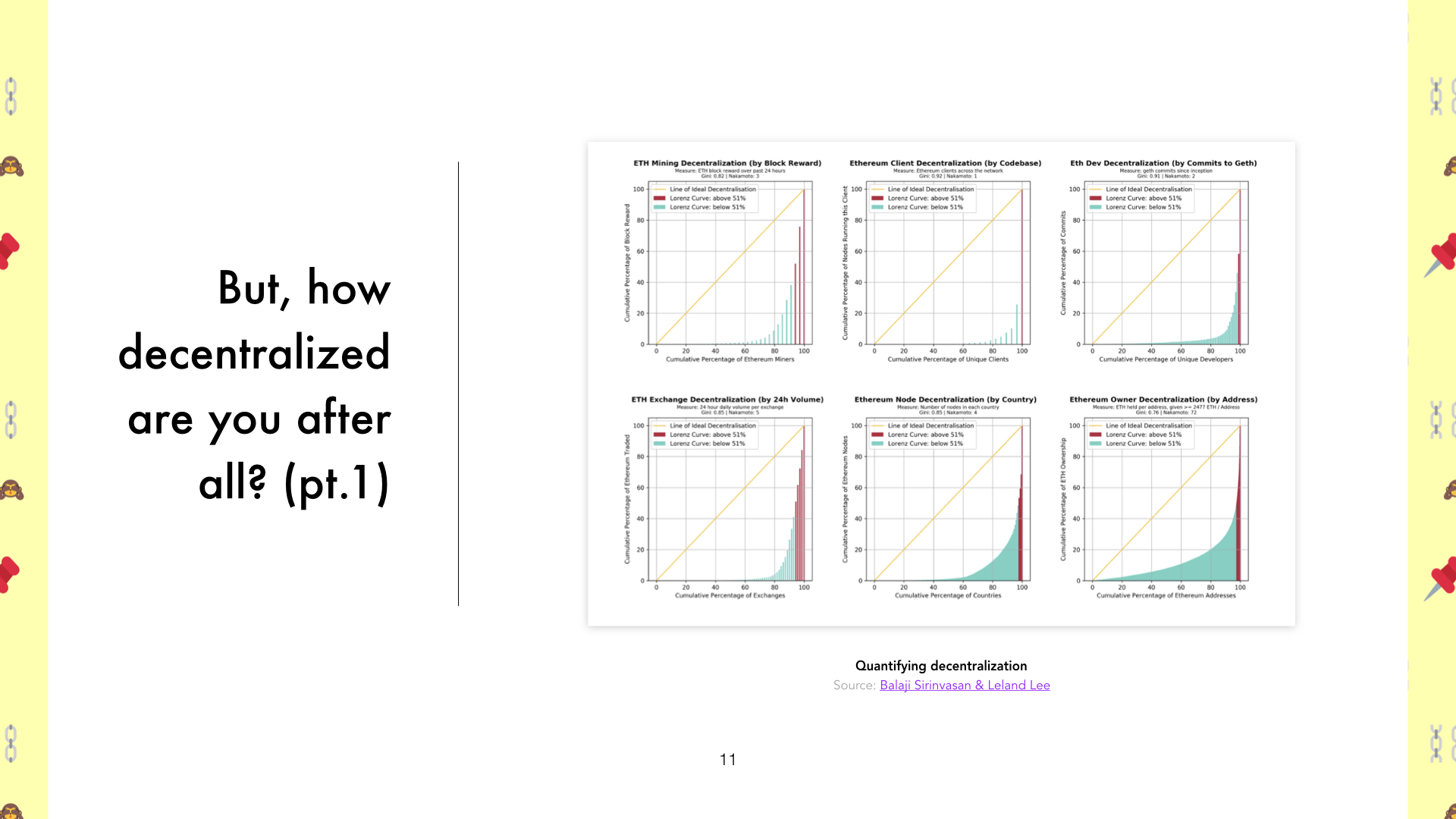

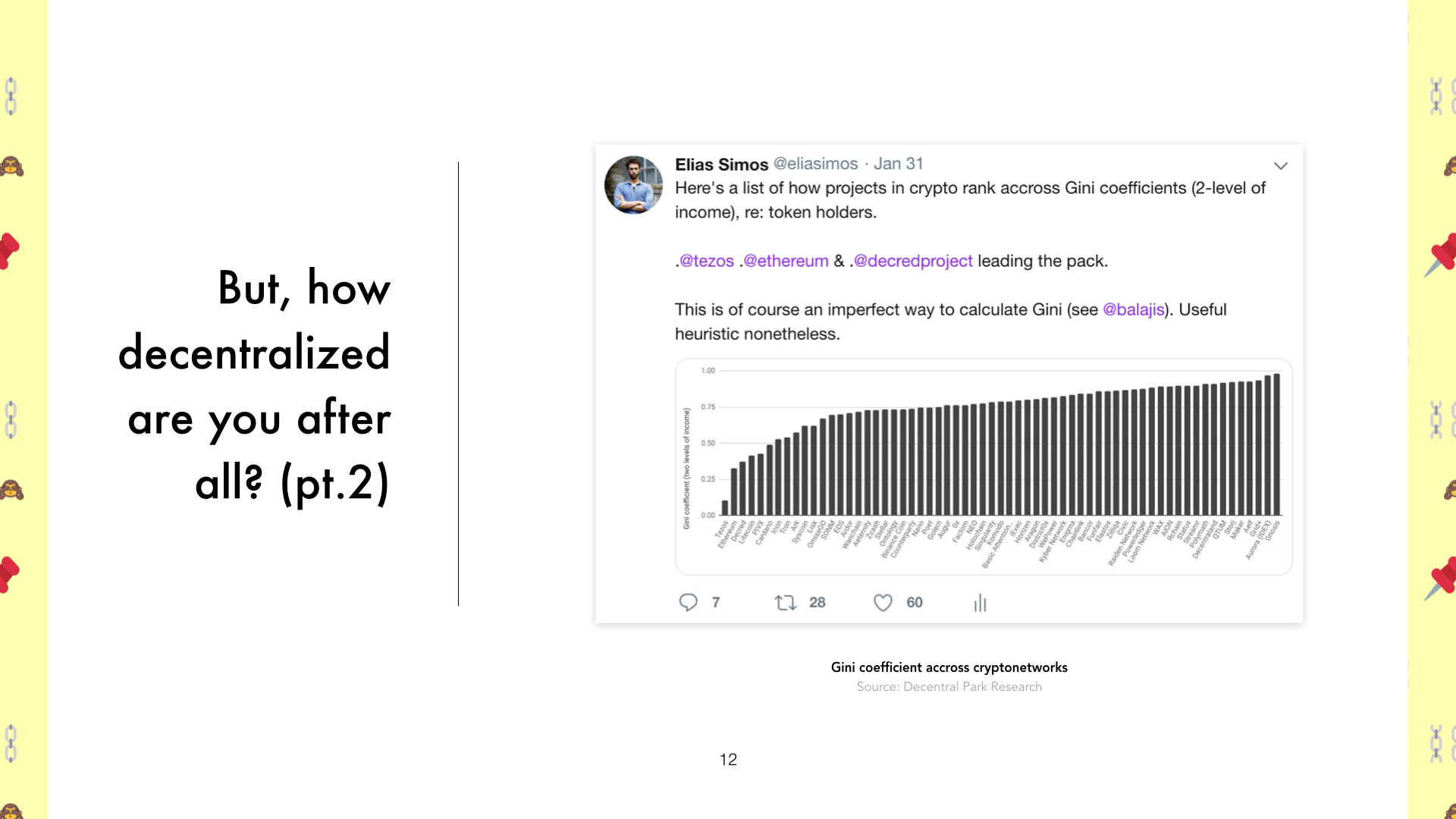

- Centralized; 10 validators control the parameters of the ecosystem. This might not matter much as long as xDai is inconsequential, but will certainly matter if/as things progress (e.g. see EOS).

For all its promise, xDai seems to lose out in a tit for tat and leaves the observer with much more to be desired...